Locate Your Business Here

Opening a new branch or relocating your business or industry can be a daunting task, and the Dyer Industrial Development Board along with Gibson County economic development wants to make it little easier for you. We’ve compiled the information you need in one easy to navigate location. Need more info? Please don’t hesitate to call us Dyer IDB at 731-692-3767 Or Gibson County Economic Development at 731-855-7613. We’ll be more than happy to help or point you in the right direction.

Stats & Demographics

Incentives

Tax Information

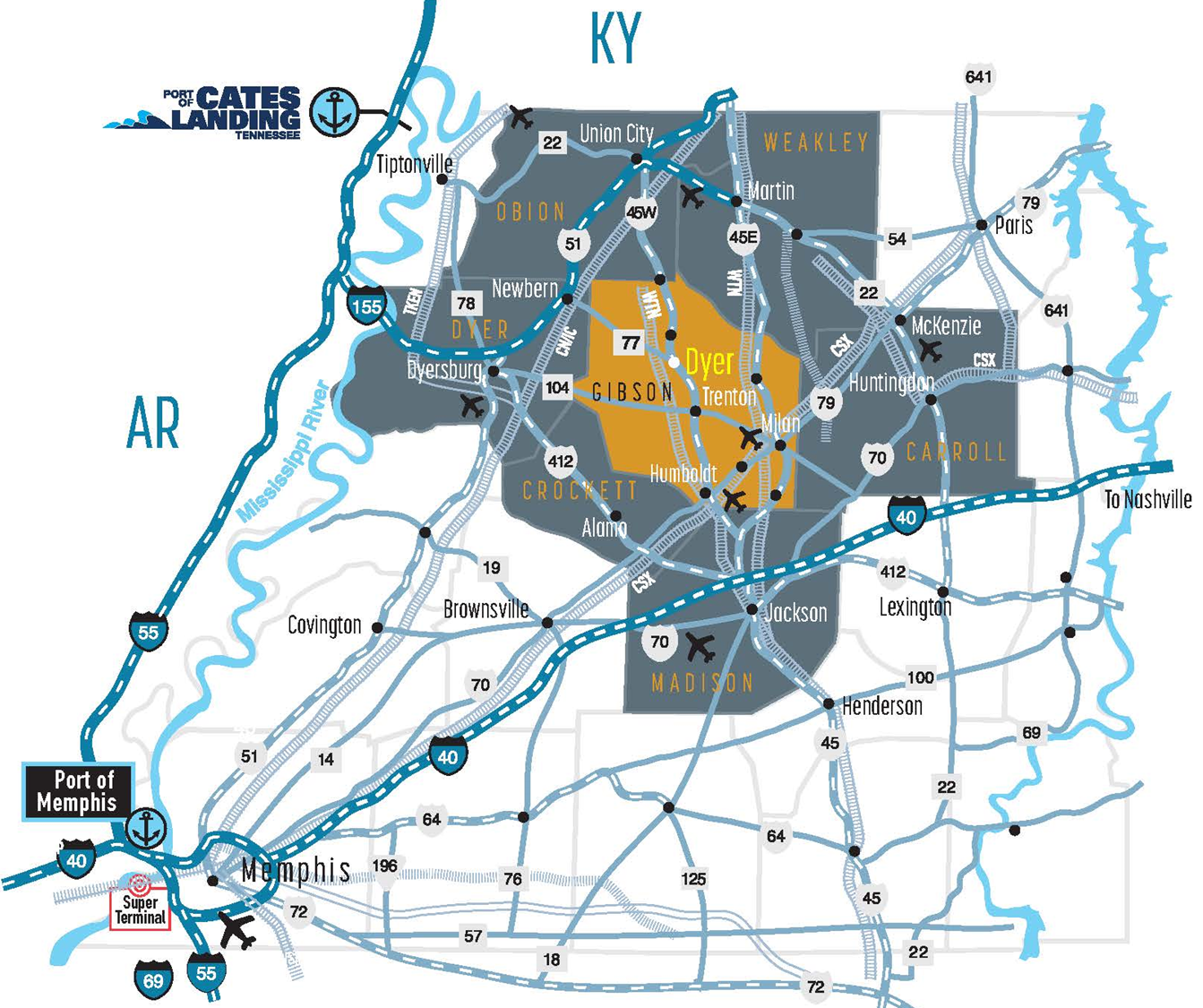

Transportation

Maps

Demographics Market Analyses

Click on the image or button to view the full report

Below you will find our Demographics Report for the Dyer Industrial Park Select Tennessee Certified Site, supplied in partnership with the Tennessee Department of Economic and Community Development and ESRI.

Summary

| Census 2010 | 2021 | 2026 | |

| Population | 2,347 | 2,263 | 2,230 |

| Households | 906 | 865 | 851 |

| Families | 615 | 599 | 586 |

| Average Household Size | 2.47 | 2.5 | 2.51 |

| Owner Occupied Housing Units | 618 | 613 | 605 |

| Renter Occupied Housing Units | 288 | 252 | 246 |

| Median Age | 39.8 | 44.4 | 45.7 |

Trends: 2021-2026 Annual Rate

| Area | State | National | |

| Population | -0.29% | 0.89% | 0.71% |

| Households | -0.33% | 0.91% | 0.71% |

| Families | -0.44% | 0.79% | 0.64% |

| Median Household Income | 3.88% | 2.14% | 2.41% |

Households by Income

| 2021 Number | 2021 Percentage | 2026 Number | 2026 Percentage | |

| <$15,000 | 159 | 18.40% | 144 | 16.92% |

| $15,000 – $24,999 | 111 | 12.80% | 102 | 11.99% |

| $25,000 – $34,999 | 156 | 18.00% | 123 | 14.45% |

| $35,000 – $49,999 | 100 | 11.60% | 91 | 10.69% |

| $50,000 – $74,999 | 134 | 15.50% | 139 | 16.33% |

| $75,000 – $99,999 | 81 | 9.40% | 91 | 10.69% |

| $100,000 – $149,999 | 77 | 8.90% | 99 | 11.63% |

| $150,000 – $199,999 | 23 | 2.70% | 31 | 3.64% |

| $200,000+ | 25 | 2.90% | 31 | 3.64% |

Population by Age

| Census 2010 Number | Census 2010 Percentage | 2021 Number | 2021 Percentage | 2026 Number | 2026 Percentage | |

| 0 – 4 | 145 | 6.18% | 115 | 5.08% | 107 | 4.80% |

| 5 – 9 | 161 | 6.86% | 114 | 5.04% | 116 | 5.20% |

| 10 – 14 | 171 | 7.29% | 115 | 5.08% | 118 | 5.29% |

| 15 – 19 | 163 | 6.95% | 126 | 5.57% | 113 | 5.07% |

| 20 – 24 | 133 | 5.67% | 135 | 5.97% | 117 | 5.25% |

| 25 – 34 | 275 | 11.72% | 289 | 12.77% | 281 | 12.60% |

| 35 – 44 | 258 | 10.99% | 255 | 11.27% | 246 | 11.03% |

| 45 – 54 | 294 | 12.53% | 254 | 11.22% | 258 | 11.57% |

| 55 – 64 | 245 | 10.44% | 303 | 13.39% | 282 | 12.65% |

| 65 – 74 | 233 | 9.93% | 268 | 11.84% | 275 | 12.33% |

| 75 – 84 | 167 | 7.12% | 191 | 8.44% | 219 | 9.82% |

| 85+ | 102 | 4.35% | 99 | 4.37% | 101 | 4.53% |

Race and Ethnicity

| Census 2010 Number | Census 2010 Percentage | 2021 Number | 2021 Percentage | 2026 Number | 2026 Percentage | |

| White Alone | 1,825 | 77.76% | 1,851 | 81.79% | 1,815 | 81.39% |

| Black Alone | 463 | 19.73% | 334 | 14.76% | 320 | 14.35% |

| American Indian Alone | 1 | 0.04% | 2 | 0.09% | 2 | 0.09% |

| Asian Alone | 3 | 0.13% | 6 | 0.27% | 8 | 0.36% |

| Pacific Islander Alone | 0 | 0.00% | 0 | 0.00% | 0 | 0.00% |

| Some Other Race Alone | 2 | 0.09% | 8 | 0.35% | 10 | 0.45% |

| Two or More Races | 53 | 2.26% | 62 | 2.74% | 76 | 3.41% |

| Hispanic Origin (Any Race) | 20 | 0.85% | 31 | 1.37% | 36 | 1.61% |

Educational Attainment 2021

| Area | State | National | |

| Associate’s Degree | 8.68% | 7.49% | 8.67% |

| Bachelor’s Degree | 10.61% | 18.43% | 20.60% |

| Graduate Degree | 7.66% | 11.06% | 13.00% |

Incentives

The City of Dyer is a great place to build and grow your business. For more information about Dyer’s attractive business incentives, contact the Gibson County Economic Development Director, Kingsley Brock 731-855-7613.

Industrial Incentives

Incentivized Tax Structure

With one of the nation’s lowest per capita tax burdens, Dyer is one of the best places in the country to locate your industry. The primary business taxes in Dyer are the franchise tax and the excise tax (F&E).

Job Tax Credit

In Dyer, Tennessee, “qualified business enterprises” could be granted a credit against their franchise and excise taxes based on their capital investment and the number of jobs created. The amount of the credit and the period of time during which it can be used varies according to the size of the investment.

Industrial Machinery Tax Credit

For capital investments in industrial machinery, Tennessee offers businesses an Industrial Machinery Tax Credit that may be used to offset up to 50% of the company’s F&E tax liability. To qualify for this credit, companies are not required to create new jobs. The credit applies to the purchase, installation and repair of industrial machinery as defined in T.C.A. 67-6-102. The credit also applies to the purchase and installation of computers, computer software and certain peripheral devices purchased in order to meet the capital investment thresholds of the Job Tax Credit.

Headquarters Tax Incentives

In order to encourage companies to locate and expand their regional, national or international corporate headquarters in Tennessee, the State offers a suite of enhanced tax credits to companies that establish or expand a qualified headquarters facility. A “qualified headquarters facility” means a regional, national or international headquarters facility where the taxpayer has:

- Made a minimum investment of $50 million in a headquarters building or buildings, newly constructed, expanded or remodeled during the investment period;

- Made a minimum investment of $10 million in a headquarters facility and created 100 new full-time jobs paying at least 150% of Tennessee’s average occupational wage during the investment period, or;

- Located its headquarters facility in a Central Business District or Economic Recovery Zone and received approval from the Commissioner of Revenue as a “qualified headquarters facility.”

Other

PILOT and TIF programs are available.

Tax Information

Tennessee is consistently named one of the best states for doing business, and that is due in part to the tax structure. And not only do businesses like locating here, our residents enjoy living in one of the few states without a personal income tax.

There are various taxes collected at the city, county, and state level. For a description and information about taxes levied by the state, please refer to the State of Tennessee’s tax guides on their website. These taxes include sales and use taxes, excise tax, and franchise tax.

At the local level, the main taxes collected by the city and county are property taxes, special school district taxes, and the local option sales tax. Below are some key tax rates related to living and working in Dyer, Tennessee.

Sales Tax

State of Tennessee 7% (4% for groceries)

Local Option 2.75%

Total Sales Tax 9.75% (6.75% for groceries)

Property Tax

Property taxes are based on an assessed value. That assessed value is a percentage of the appraised value based on the type of use. Assessment ratios are as follows: Residential and farm – 25%

Commercial and industrial – 40%

Public utility – 55%

Business personal property – 30% The tax rates listed for cities and counties is the amount paid per $100 of assessed value. For instance, a house appraised for $100,000 would have an assessed value of $25,000. If the tax rate is $4.00 per $100 of assessed value, the tax owed would be $1,000. ($4.00 x $25,000/$100)In Gibson County, property taxes are based on a county, city, and special school district (SSD) tax. There are four special school districts covering the entire county except Humboldt, which funds its schools through the city’s property tax.

Here are the tax rates in Gibson County based on location…

|

City Name |

Special School District (SSD) |

County Rate |

City Rate |

SSD Rate |

Total |

|

YORKVILLE |

GIBSON CO SSD |

$1.0322 |

$0.5614 |

$2.0103 |

$3.604 |

|

TRENTON |

TRENTON SSD |

$1.0322 |

$1.63 |

$2.1105 |

$4.773 |

|

RUTHERFORD |

GIBSON CO SSD |

$1.0322 |

$1.94 |

$2.0103 |

$4.983 |

|

MILAN |

MILAN SSD |

$1.0322 |

$1.6022 |

$2.23 |

$4.864 |

|

MEDINA |

GIBSON CO SSD |

$1.0322 |

$1.5671 |

$2.0103 |

$4.61 |

|

KENTON |

KENTON SSD/GIBSON CO SSD |

$1.0322 |

$1.4883 |

$2.4203 |

$4.941 |

|

HUMBOLDT |

HUMBOLDT SSD |

$1.0322 |

$2.7297 (Includes City School Tax) |

|

$3.762 |

|

GIBSON |

GIBSON CO SSD |

$1.0322 |

$0.9864 |

$2.0103 |

$4.029 |

|

DYER |

GIBSON CO SSD |

$1.0322 |

$1.93 |

$2.0103 |

$4.973 |

|

BRADFORD |

BRADFORD SSD |

$1.0322 |

$1.77 |

$1.7349 |

$4.537 |

SSD = Special School District Tax

Transportation

- 27 Miles to Union City

-

- I-55 & I-24 & Future I-69

- 35 Miles to I-40 in Jackson

- 38 Miles to McKellar-Sipes Air

-

- Atlanta & St. Louis daily

- 38 Miles to TCAT Jackson

- 38 Miles to Jackson State Community College

- 116 Miles to Memphis

Airports

Humboldt Municipal Airport is located only twenty-two miles from the downtown and industrial area and serves Dyer. Airport facilities are equipped to handle up to medium size business jets. The airport has one 4000 x 75-foot lighted runway, parallel taxi-way, and REIL and Vasi lights for both runways. Other services include crop dusting and banner towing. Flight instructions for college credit are also available at Humboldt Municipal Airport through Jackson State Community College. The Airport was renovated in 1995 with an upgraded and repaved runway. The lighting, beacon and radio communications systems were also upgraded. Comfortable lounge area with television and WiFi available.

Aircraft fuels (100 LL and Jet-A), tie-down and hangar storage are available through Humboldt’s two hangars and ramp area. Major and minor repairs can be made.

The nearest commercial service is in Jackson (39 miles) at McKellar-Sipes Regional Airport through Air Choice One. This carrier provides daily service to and from St. Louis Lambert International Airport.

Memphis International Airport (MEM) is approximately 90 miles away, while Nashville International Airport (BNA) is approximately 150 miles away.

Highways

Highway 45W along with State Highways 185 and 77 serve Dyer. U. S. Highway 45W is heavily used by motor freight transportation and has always been a main artery for traffic from the northern part of the nation to the Gulf Coast. The widening of Highways 45-E and 45-W has under construction and will connect Corinth, Mississippi with Fulton, Kentucky and will connect 1-40 at Jackson, Tennessee to the 1-55 connector in Dyersburg, Tennessee (Highway 1-155). Both roads cross through Gibson County, to provide an excellent highway network. Dyer is only 35 minutes from Interstate 40, a main east-west artery, and approximately 25 miles from Interstate 155 and the new expansion of I-69.

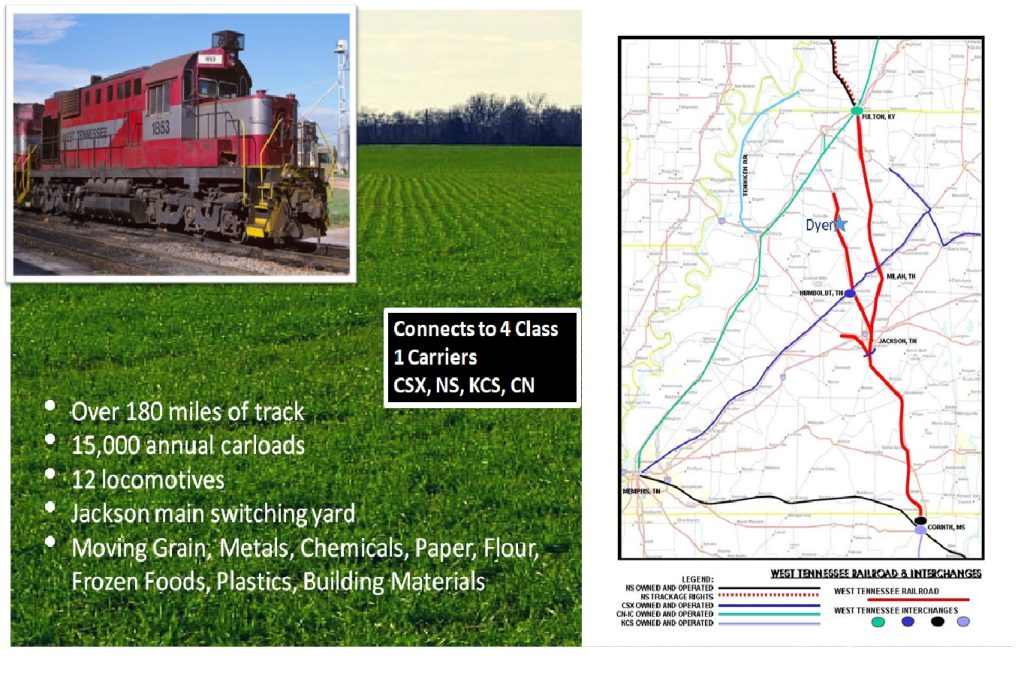

Railroad

The West Tennessee Railroad (WTNN) provides rail service in Humboldt. Formed as a short line in 1984 and expanded in 2001, the WTNN provides direct interchange connections to four major Class I railroads: the Canadian National at Fulton, KY; the CSX Railroad at Humboldt, TN; and the Norfolk Southern Railroad and Kansas City Southern Railroad at Corinth, MS. These interchanges ensure that competitive rail rates can be maintained to virtually any rail destination. Switching services are available seven days a week. River port-to-rail transloading facilities exist on the Mississippi River at Memphis, TN on the Canadian National and on the Tennessee River at Yellow Creek, MS on the Kansas City Southern.

River Port

The newly opened river port of Cates Landing located at Tiptonville Tennessee is less than an hour away via state HWY 77. Provide waterway transportation to Mississippi river ports and to the Gulf of Mexico. Port of Cates Landing